Investing in real estate can be an exciting way to grow your wealth, but it often comes with questions about risk. How do you know if you’re making the right choices? How can you protect yourself from market changes or unexpected challenges? That’s where tools like the Portfolio Risk Formula come in.

At Lukrom, we specialize in helping investors like you navigate these challenges. Whether you’re financing a fix-and-flip project, buying rental properties, or exploring private money lending, understanding and managing risk is essential to your success. The Portfolio Risk Formula is a simple yet powerful way to see the big picture of your investments and make smarter, more confident decisions.

In this article, we’ll break down what the Portfolio Risk Formula is, how it applies to real estate, and how you can use it to build a balanced and profitable investment portfolio. Don’t worry—you don’t need to be a math wizard! We’ll guide you step by step, showing you how to reduce risks and maximize returns while taking advantage of Lukrom’s expertise in real estate financing.

1. Understanding the Portfolio Risk Formula

The Portfolio Risk Formula might sound complex, but at its core, it’s a tool to measure the overall risk of your investments. It shows how different assets (like properties or projects) work together to either increase or reduce risk. Let’s break it down into simple terms:

What Is the Portfolio Risk Formula?

Think of it as a formula that calculates the “bumpiness” of your investment journey:

- Risk of Individual Assets: Every property or project has its own level of risk (e.g., market volatility, property repairs).

- Weights: This is how much of your money you’ve allocated to each asset. For instance:

- 70% in a rental property.

- 30% in a fix-and-flip project.

- Relationships Between Assets: How do your investments move together? If one property struggles but another thrives, they balance each other out—this is called correlation.

Why Is the Risk Portfolio Formula Important?

Understanding these components helps you:

- Minimize Overall Risk: By combining different types of investments, you can reduce volatility.

- Make Informed Choices: See how much risk you’re taking on and whether it aligns with your goals.

- Plan for Growth: Know when to diversify (spread your investments) to create stability.

Breaking It Down With Real Estate Examples:

- High-Risk Assets: Fix-and-flip projects can generate big returns but also come with market uncertainties.

- Moderate-Risk Assets: Long-term rental properties offer steady income but may face tenant or maintenance issues.

- Low-Risk Assets: Investments in REITs or real estate funds spread your risk by pooling multiple properties.

When the Risk Portfolio Formula is applied to real estate, it helps investors assess how the mix of different properties (e.g., residential, commercial, and raw land) will behave collectively. For instance, combining a high-risk fix-and-flip project with a stable rental property can reduce overall portfolio volatility.

In real estate, understanding the correlation between different asset types and geographic locations is critical. Diversifying across these factors lowers the impact of local market downturns or shifts in property demand, leading to a more balanced portfolio risk.

2. Application to Real Estate Portfolios

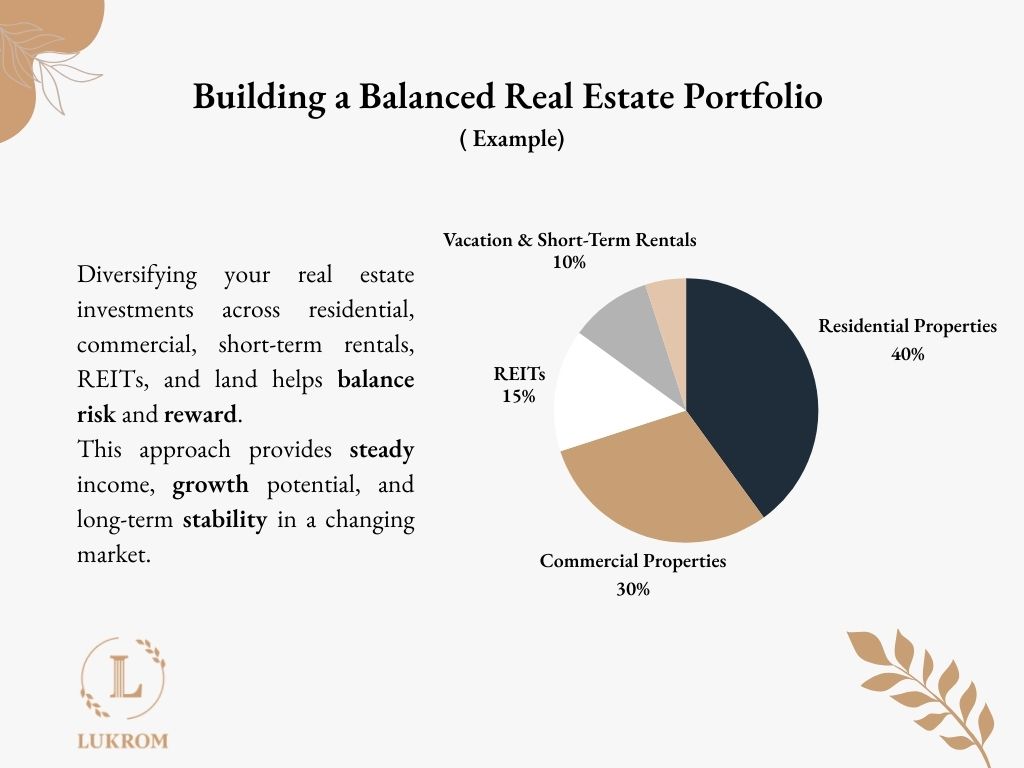

Diversification is a key strategy in managing risk within a real estate portfolio. By combining different types of properties and investment strategies, you can reduce the overall volatility and better weather market fluctuations. Here’s how diversification applies to real estate:

- Geographic Diversification: Investing in properties across different regions can protect your portfolio from localized market downturns. For instance, while one city may experience a real estate slump, another might be thriving due to strong economic conditions or population growth.

- Property Types: Mixing various property types—residential, commercial, and industrial—helps balance risk. Residential properties often provide stable cash flow, while commercial or industrial properties can offer higher returns but may come with increased risk.

- Financing Methods: The way you finance your real estate investments also plays a role in diversification. Using different financing strategies—such as traditional mortgages, private loans, or crowdfunding—can provide a cushion against interest rate changes or lending market shifts.

3. Example of Real Estate Portfolio Diversification:

Imagine combining:

- High-yield fix-and-flip projects: These have higher risk but offer the potential for significant short-term profits.

- Stable rental properties: These offer steady, long-term income with lower risk and volatility.

- Real Estate Investment Trusts (REITs): These provide exposure to a broad range of real estate assets without the need to manage individual properties, spreading risk across multiple sectors and regions.

By diversifying in this way, you reduce the risk that any single asset will cause significant damage to your entire portfolio. The more diversified your portfolio, the more likely it is to handle shifts in the market with stability.

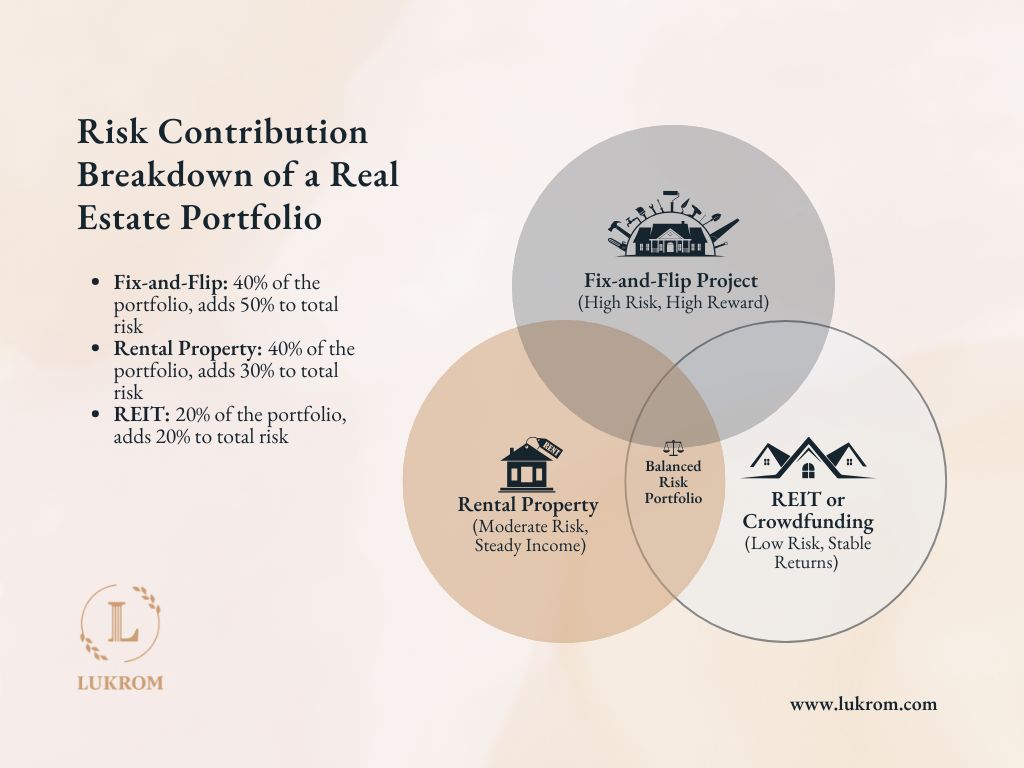

4. Case Study: Balancing Risk in a Real Estate Portfolio

Let’s look at an example of how the portfolio risk formula works in a real estate portfolio. We will use three types of investments, each with different levels of risk:

- Fix-and-Flip Project:

- Risk: High risk because the project’s success depends on market conditions, costs, and timing.

- Return: High reward if the project is successful, but it can be unpredictable.

- Role: Adds risk to the portfolio, but it has the potential for a big payoff.

- Rental Property:

- Risk: Moderate risk, as the property can generate steady income, but it still depends on things like tenant demand and maintenance costs.

- Return: Steady monthly rent payments, plus potential property value growth over time.

- Role: Adds stability to the portfolio, with less risk than a fix-and-flip.

- Real Estate Investment Trust (REIT) or Crowdfunding Investment:

- Risk: Low risk, as these investments are spread across many properties.

- Return: Provides regular returns from a range of real estate investments, offering more stability.

- Role: Helps balance out the risk from the fix-and-flip and rental property by adding diversity.

How the Formula Works:

We use the portfolio risk formula to see how each of these investments affects the overall risk. The formula looks at three things:

- Weights: This is the percentage of each investment in the portfolio. For example, the fix-and-flip project might be 40%, the rental property 40%, and the REIT investment 20%.

- Variance: This is the risk for each investment. The fix-and-flip project has a higher variance because it’s riskier, while the REIT has a lower variance.

- Covariance: This shows how the investments move together. For example, both the fix-and-flip and rental property can be affected by local market conditions, while the REIT might not be as affected.

When we put these together, the goal is to lower the overall risk by balancing high-risk and low-risk investments. This way, the portfolio is more stable, even if one investment does poorly.

5. Practical Tips for Real Estate Investors

1. Assessing Correlations Between Real Estate Markets

Understanding the relationships between different real estate markets is key to managing risk in your portfolio. Markets with a high correlation tend to rise or fall together, which can increase your overall risk if one market experiences a downturn. Conversely, markets with low or negative correlation behave independently or oppositely, helping to balance risk across your investments.

Practical Tips for Assessing Market Correlations:

- Evaluate Local Economic Conditions: Look at factors like unemployment rates, median household income, and industry growth within a market to understand the economic health and future potential.

- Compare Similar Markets: For example, compare rental yields in two neighboring cities or regions to see if their market trends align. If one market is booming while another is declining, it may indicate a correlation you want to avoid.

- Use Property Price Trends: Look at historical property price movements to see if markets behave similarly. If one market sees a spike during certain economic conditions, a similar market may follow.

2. Calculating and Managing Risk Without Complicated Software

Investors don’t need complex software to calculate risk. You can manually evaluate risks by calculating the weight of each investment in your portfolio and understanding its potential impact.

Risk Calculation Simplified:

- Determine Asset Weight: The proportion of each investment in your portfolio (e.g., 40% in rental properties, 30% in fix-and-flip projects).

- Assess Asset Volatility (Variance): Understand how much the value of an asset fluctuates. More volatile assets (like fix-and-flip projects) bring higher risk.

- Calculate Portfolio Risk: Multiply the asset weight by its volatility, and then consider how assets interact (correlation). For example, if two assets are highly correlated, their combined risk is higher.

Example Table for Risk Calculation:

| Asset Type | Portfolio Weight | Asset Volatility | Risk Contribution (%) |

| Fix-and-Flip | 40% | High (50%) | 20% |

| Rental Property | 40% | Moderate (30%) | 12% |

| REIT (Low Risk) | 20% | Low (20%) | 4% |

| Total Portfolio Risk | 100% | 36% |

In this simplified example, you can see how each asset’s risk contributes to the total risk of your portfolio. By diversifying with different risk levels, you can reduce overall exposure.

3. Financing Strategies to Mitigate Risk

Financing strategies can significantly affect your portfolio risk. The right type of financing can help reduce risk, give you more flexibility, and improve your cash flow.

Practical Tips for Financing:

- Use Conservative Leverage: Avoid over-leveraging (borrowing too much) as this increases risk. A lower Loan-to-Value (LTV) ratio (e.g., 60%-70%) provides more financial security, as you’re less dependent on rising property values to pay back loans.

- Opt for Long-Term Financing: Fixed-rate mortgages with long terms (e.g., 15–30 years) reduce the risk of fluctuating monthly payments and provide more stable cash flow.

- Private Loans and Partnerships: If you’re open to non-traditional financing, consider using private loans or joint ventures. These options can provide better terms and more flexible payment structures, reducing the risk from tighter financing sources like banks.

4. Diversification of Property Types and Locations

Diversifying across different property types (e.g., residential, commercial, and REITs) and locations (e.g., urban vs. suburban) helps reduce risk by spreading exposure to different market forces. While a recession might impact commercial properties, residential investments may be more stable. Diversification can ensure you’re not overly exposed to one type of market.

Diversification Tips:

- Geographic Spread: Invest in properties across multiple cities or states, especially if certain regions are more prone to economic fluctuations.

- Diversify Property Types: Consider balancing high-risk, high-reward investments like fix-and-flips with more stable, low-risk investments such as rental properties or REITs.

5. Regular Portfolio Review and Rebalancing

Once you’ve set up your portfolio, remember that risk management is an ongoing process. Regularly reviewing and rebalancing your portfolio helps you adjust to market changes and your financial goals. A property that was once a great investment may no longer align with your risk tolerance or income requirements.

Practical Tips for Rebalancing:

- Review Your Portfolio Annually: Look at how each investment is performing and whether it’s still meeting your risk and return expectations.

- Rebalance When Necessary: If certain investments have increased in value, you may need to sell or reduce your exposure to keep your risk balanced.

- Set Risk Tolerance Limits: Decide on a risk threshold for your portfolio and make adjustments when you approach that limit.

By applying these practical tips and strategies, you can better assess risk, ensure diversification, and make informed decisions that will help your real estate portfolio thrive in both good times and bad.

Conclusion

Managing risk is an essential skill for real estate investors who want to build and maintain a profitable portfolio. By understanding key principles like diversification, portfolio risk calculation, and the role of financing strategies, you can reduce exposure to high-risk investments and create a more stable, balanced portfolio.

Applying the portfolio risk formula, assessing market correlations, and utilizing different types of properties and financing strategies are all practical methods to mitigate risk. Regular portfolio reviews and rebalancing ensure that your investments remain aligned with your goals and risk tolerance.

Pro Tip: Partner with experts, like Lukrom, to leverage tailored financing solutions that can help you optimize your portfolio and manage risks efficiently. With the right strategies and tools in place, you can confidently navigate the real estate market and enjoy consistent returns over time.